Clean Energy Rebates & Incentives

Heat Pumps

Federal | Massachusetts | Rhode Island

Federal Tax Credit (Ends Dec. 31, 2025)

- 30% up to $2,000/year for heat pumps & heat pump water heaters

- Tax credit limited to a total of $3,200 per year for combined measures

- No rollovers

- More details

Federal Energy Efficiency Rebates

- State-specific applications and qualifications:

-

- Rhode Island: The Home Electrification and Appliance Rebate is open for low-income households. The moderate-income pathway is expected to launch late 2025. Learn more.

-

- Massachusetts: The state plans to launch its IRA rebate program in late 2025. You can sign up to receive updates here: Sign up.

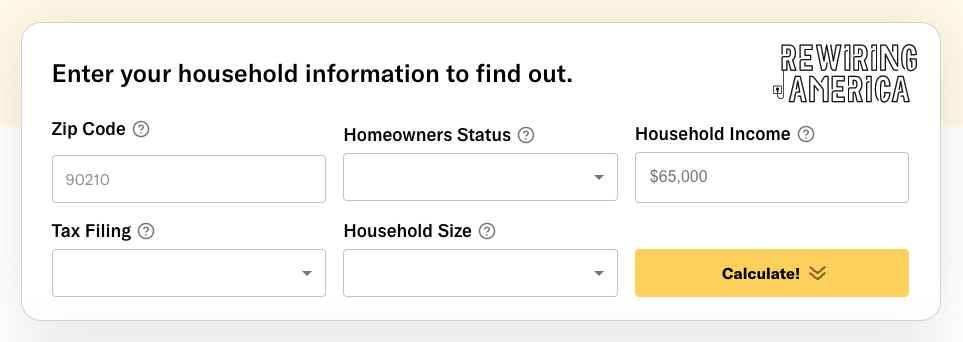

- For more information, see the Rewiring America calculator

MassSave Rebates

Whole Home

-

$3,000/ton (12,000 BTU) of heating capacity, up to $10,000 ($16,000 for moderate income)

-

Must be sized properly for 100% of home’s need

-

Legacy system must be disconnected from thermostat or removed

Partial Home

- $1,250 per ton (12,000 BTU) of heating capacity ($16,000 for moderate income)

- Integrated controls may be required

- $500 adder if adding insulation

MassSave HEAT Loan Program

-

$25,000 zero-interest rate loan

-

Batteries may earn money from Connected Solutions program

Clean Heat RI Rebates

- This program is available to all Rhode Islanders who heat with oil, propane, or natural gas. If you heat with electric resistance, see Rhode Island Energy’s rebate program below.

- For heat pumps, the incentive amount is 60% of heat pump system and installation costs up to $11,500. For heat pump water heaters, the incentive is $2,500. Overall, the Clean Heat RI incentives are capped at $18,000 per residential address.

- For a breakdown of eligibility requirements and incentives, visit the website.

Rhode Island Energy rebates

- If you are upgrading to a heat pump from electric resistance, you are eligible for a rebate up to $1,250 per ton of equipment capacity. If you are a natural gas, electric, oil, or propane customer switching to heat pumps, you may qualify for the Standard Rebate of up to $400 per ton.

- If you are upgrading to a heat pump water heater (either by replacing an existing electric water heater or installing one for the first time in a newly constructed home), you are eligible for a heat pump water heater rebate up to $800 (the regular rebate is $600).

Rewiring America RI Heat Pump Access Program

Rewiring America has partnered with global manufacturers and local contractors to offer Rhode Island homeowners brand new heat pumps at a 20-30% reduced cost compared to standard market pricing.

Program Eligibility:

- Residents of RI

- 60-150% State Median Income (SMI)

- Own or live in a 1-4 unit building (attached/detached)

- Through the program, GEM Plumbing and Heating would be the installation partners, Abode Energy, the Clean Heat Rhode Island administrator, would be the heat pump experts that customers can refer to, and Capital Good Fund, alongside other lending partners, would be the recommended partner for low- or no-interest financing options

- This incentive can be stacked with other incentives such as the Clean Heat Rhode Island incentive and federal tax credit

- For a breakdown of potential savings or to schedule a free consultation, visit their website.

Electric Vehicles

Federal | Massachusetts | Rhode Island

Are you in the market for a new or used car? Have you considered going electric? Driving an EV is more cost-efficient than driving a gas car (it's cheaper to drive per mile on electricity, and there are lower and fewer maintenance costs).

Driving an EV is more affordable with the state rebate programs for new and used EVs-- MOR-EV in Massachusetts and DRIVE EV in Rhode Island. Access federal, state, and utility incentives for installing EV charging at home – even if you rent.

Take a look at our EV Finder to learn more about different car models and incentives.

The federal incentive for charging will expire on June 30, 2026. Act now to access this incentive and save even more on installing a charger!

The federal tax credit for new and used battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) sadly expired on September 30, 2025.

Federal Incentive for Charging

The Alternative Fuel Infrastructure Tax Credit offers incentives for property owners to install EV charging stations in eligible census tracts.

Note: The federal tax credit for charging installation will no longer be available after June 30, 2026.

- Homeowners can receive a tax credit covering 30% of home charging installation costs (up to $1,000)

- Eligible census tracts are in non-urban or low-income census tracts (verify eligible census tracts here)

- Business owners are eligible for a tax credit of 30% of the cost or 6% in the case of property subject to depreciation, not to exceed $100,000.

In Massachusetts, the MOR-EV program offers five EV rebate programs: MOR-EV Standard, MOR-EV Used, MOR-EV+, MOR-EV Trade-In, and MOR-EV Trucks. Additionally, MassEVIP is a statewide rebate program for the purchase and installation of home EV chargers. Massachusetts utilities offer incentives for home EV charging installation, too.

Massachusetts MOR-EV Rebate

Available to Massachusetts residents for purchase or 36-month lease

For New EVs: MOR-EV Standard

- $3,500 for new EVs under $55,000

For Used EVs: MOR-EV Used

- $3,500 for used EVs under $40,000

- Household income limits apply or prove participation in an income-qualifying program:

-

- $150,000 (joint filers)

-

- $112,500 (heads of household)

-

- $72,500 (single filers)

Income-Qualifying Rebate Adder: MOR-EV+

- $1,500 for income-qualified Massachusetts residents

- Prove participation in an income-qualifying program

Trade-In Rebate Adder: MOR-EV Trade-In

- $1,000 for trading in an eligible old gas-powered car

For Electric Trucks: MOR-EV Trucks

- MOR-EV Trucks: $7,500 for eligible pickup trucks

- List of eligible trucks

More information on MOR-EV here.

Massachusetts Department of Environmental Protection

- MassEVIP is a state-level program for tenants and property owners living in multi-unit dwellings with more than five units.

- Covers 60% of hardware and installation costs, with a maximum of $60,000 per street address.

Utility-Specific Programs

- National Grid & Eversource offer charging infrastructure and installation support for renters.

- Check environmental justice (EJ) census tract eligibility here.

| Single-family Homes | |

| Criteria | Rebate Amounts |

| Low-income electricity rate | Up to $1,000 for in-home infrastructure upgrades and up to $700 for the purchase of a home charger |

| Living in an EJ community | Up to $1,000 for in-home infrastructure upgrades |

| Neither on the low-income electricity rate nor living in an EJ community | Up to $700 for in-home infrastructure upgrades |

| Two-to-four-unit Homes | |

| Criteria | Rebate Amounts |

| Low-income electricity rate | Up to $2,000 for in-home infrastructure upgrades and up to $700 for the purchase of a home charger |

| Living in an EJ community | Up to $2,000 for in-home infrastructure upgrades |

| Neither on the low-income electricity rate nor living in an EJ community | Up to $1,400 for in-home infrastructure upgrades |

| Five or more-unit Homes | ||

| Criteria | Infrastructure Upgrades | Rebate Amounts |

| Living in an area that meets the income requirement of an EJ community | Both customer-side and utility-side covered up to 100% | Up to 100% of the charger costs |

| Living in an area that does not meet the above criteria but meets one or both of the other two EJ requirements | Up to 75% of the charger costs | |

| Living in an area that does not meet any of the requirements of an EJ community | Up to 50% of the charger costs | |

Municipal utilities may have programs – check with your provider!

In Rhode Island, the DRIVE EV program offers three EV rebate programs: DRIVE EV, DRIVE EV+, and DRIVE EV Fleet. Additionally, PowerUP RI is a statewide rebate program for the purchase and installation of home EV chargers.

Rhode Island DRIVE EV Rebate Program

For RI residents; lease terms must be 24+ months

New EVs

- $1,500 for new BEVs or $1,000 for new PHEVS under $60,000

Used EVs

- $1,000 for used BEVs or $750 for used PHEVs under $40,000

Income-Qualifying Rebate Adder: DRIVE+

- $1,500 for new or used BEVs

- $750 for new or used PHEVs

- Prove participation in an income-qualifying program or submit a self-attestation form of income

DRIVE EV Fleet

For small businesses, nonprofits, and public sector entities

- $1,500 for new BEVs under $60,000

- $1,000 for used BEVs under $40,000

More information on DRIVE-EV here.

PowerUp RI EV Charger Rebate Program

The Office of Energy Resources offers rebates (PowerUpRI) to residents and landlords to install EV charging stations, with higher rebates for income-qualifying residents.

| Type of Rebate | Infrastructure Upgrades | Rebate Amount | Costs Covered |

| Standard | No Upgrade Needed | 50% up to $350.00 | Purchase Price |

| Upgrade Needed | 50% up to $750.00 | Purchase and Installation | |

| Income Qualified | No Upgrade Needed | 75% up to $500.00 | Purchase Price |

| Upgrade Needed | 75% up to $1,000.00 | Purchase and Installation |

Solar

Federal | Massachusetts | Rhode Island

Federal Investment Tax Credit (ITC) - Residential

The federal ITC (Section 25D) allows homeowners to claim 30% of their solar panel system costs as a tax credit on their federal taxes. In order to qualify, your solar system must have “expenditures made” by December 31st, 2025.

While interpretations of “expenditures made” vary, the safest option is to have your system installed and operating by December 31st, 2025, which is when the residential ITC expires. If utility delays prevent full interconnection, you may still qualify as long as installation is complete. Keep all receipts and installation records in case of an IRS audit. Here is Energy Sage’s FAQ with more information.

- If you purchased a solar system either with cash or a solar loan, you are eligible for this tax credit (if you sign a solar lease or PPA for the system, you are ineligible for).

- If you do not have a large enough tax bill to claim the entire credit in one year, then one will receive credits equal to their tax liability.

- Costs that are eligible for the tax credit include solar panels, additional solar equipment (e.g. inverters, wiring, mounting hardware), labor costs for installation, and energy storage systems. Costs that are ineligible for the tax credit include roof repairs, roof replacements, or tree trimming or removal.

- You can find more information here.

Federal Investment Tax Credit (ITC) - Commercial

Systems that are leased or owned by third parties will still qualify for the commercial 30% ITC beyond 2025 (Section 48E). In these cases, the solar or battery developer receives the credit and, depending on the company, should pass some of that value to you through lower monthly lease payments.

- For solar, the third-party system must begin construction before July 2026 and be placed in service by December 31, 2027. For battery storage, the 48E credit remains available but begins to phase down in 2034 to 22.5%, 15% in 2035, and expires entirely in 2036.

- To remain eligible for the Investment Tax Credit after this year, solar and battery developers must comply with Foreign Entity of Concern requirements.

- You can learn more about solar leases and the federal tax credit here and battery leases and the federal tax credit here.

Solar Massachusetts Renewable Target (SMART) Program

The SMART program is an incentive program for solar projects in Massachusetts, which provides compensation for solar projects if they meet certain criteria.

There is still some allocation in SMART 2.0, but SMART 3.0 is the most recent version of the program that is currently in development and is expected to come out soon.

- To qualify for SMART 3.0, a project must provide documentation to show that on-site construction did NOT begin before June 20, 2025, but the current SMART 2.0 program will remain open for applications until December 21, 2026. To qualify for that, the project must provide documentation to show that on-site construction began before December 31, 2025.

- Most residential projects would most likely be under 25 kW, and those projects will have a fixed incentive level of $0.03/kWh under SMART 3.0. Projects under 25 kW that serve low-income customers will have a fixed incentive level of $0.06/kWh.

- There are adder incentive values available for certain projects based on location, offtakers, and more.

Net Metering

Net metering is a renewable rate program in Massachusetts that allows customers to offset their energy use and transfer energy back to their electric companies via their systems in exchange for a bill credit.

- One must be serviced by Eversource, National Grid, or Unitil to participate in net metering.

- Customers who net meter are billed for their net consumption of electricity, which is calculated by the total electricity consumed in a month subtracted by the total electricity generated in a month.

- If your net consumption is positive, meaning your electricity generated covers only a portion of your consumption, you would pay the remaining balance to your electric company. The energy generated would show up as a net meter credit subtracted from your balance.

- If your net consumption is negative, you would not owe anything as the net metering credit would appear on your bill.

- Net metering credits do not expire and will rollover to the next billing period.

Residential Energy Credit

If you are a Massachusetts resident and install a system on your primary residence, you qualify for the MA Residential Energy Credit worth 15% of your solar panel system cost, up to $1,000, that is applied towards your MA state income tax bill.

The amount of the energy credit claimed by the taxpayer in a taxable year may not exceed the taxpayer’s personal income tax liability for that year, but a taxpayer may carry-over any excess credit amount for up to three succeeding taxable years.

Net Metering

Net metering is a renewable rate program in Rhode Island that allows customers to offset their energy use and transfer energy back to the electric company via their systems in exchange for a bill credit. Participants can receive bill credits for up to 125% of the on-site consumption during a billing period.

- One must be serviced by Rhode Island Energy to participate in net metering.

- Customers who net meter are billed for their net consumption of electricity, which is calculated by the total electricity consumed in a month subtracted by the total electricity generated in a month.

- If your net consumption is positive, meaning your electricity generated covers only a portion of your consumption, you would pay the remaining balance to your electric company. The energy generated would show up as a net meter credit subtracted from your balance.

- If your net consumption is negative, you would not owe anything as the net metering credit would appear on your bill.

- You cannot participate both in net metering and the Renewable Energy Growth (REG) program.

Renewable Energy Fund (REF) Small-Scale Solar Program

The REF Small-Scale Solar Program provides up to a $5,000 max incentive per project towards renewable energy installations for residential homes. Depending on the size of the system, a grant amount is calculated, subtracted from the total project cost, and then awarded to the installer upon the completion and successful inspection of the project.

- Through this program, there is also an Energy Storage Adder grant that is a max $2,000 per project.

- There are two more upcoming scheduled grant rounds: for small-scale, September 12, 2025, and October 24, 2025. These rounds will open at 9:00 AM and close at 5:00 PM the same day.

- You cannot participate in both the Renewable Energy Fund (REF) Small-Scale Program and the Renewable Energy Growth (REG) program.

Renewable Energy Growth (REG) Small-Scale Program

This program allows participants to sell the energy generated by their solar systems at fixed prices over the course of 15 to 20 years, depending on the project size, and it is available to homeowners and small commercial customers for projects 25 kW and smaller.

For residential customers, the account owner will receive a bill credit for energy and the system owner will be paid the remaining Performance-Based Incentive (PBI), which are funded through the REG program on customers’ bills, are set by the RI Distributed Generation Board, and are approved by the Rhode Island Public Utilities Commission.

The program year opens on April 1st each year and is available on a first come, first serve basis until the program is fully subscribed or until March 31, 2026, the end of the program year.

- To qualify, residential customer projects must be located at a customer residence that receives electric service under the Basic Residential Rate A-16 or Low-Income Rate A-60, and projects can neither be operational at time of application nor under construction, except for site work that is less than 25% of the total project cost.

- You cannot participate in both the REG program and net metering.

- You cannot participate in both the Renewable Energy Growth (REG) program and the Renewable Energy Fund (REF) Small-Scale Program.

Back to Top

Other Energy Upgrades

Connected Solutions

This program aims to reduce peak load demand on the grid as utilities will pay their customers to participate in the program and help decrease overall costs of running expensive, high-emission power plants.

There are two types of enrollments, battery and thermostat enrollment. Battery enrollment allows utilities to pull energy from homeowners' batteries. Thermostat enrollment allows the utility to tap into your thermostat and raise the temperature of your home by a few degrees for a couple of hours during peak demand.

The current participating utilities are National Grid, Rhode Island Energy, Eversource, Cape Light Compact, and Unitil respectively.

The incentives are as follows:

- Thermostat incentives are normally $50 enrollment and $20 each summer per thermostat. There's a $100 enrollment incentive for customers on the R2 rate.

- Battery incentives are $225-275 per kW depending on the utility. Unitil does not provide a battery incentive.

- If you live in Massachusetts and are serviced by National Grid, there is an enhanced program option which offers higher incentive rewards, such as $125 per enrolled thermostat and $400 per kW during peak events for batteries.